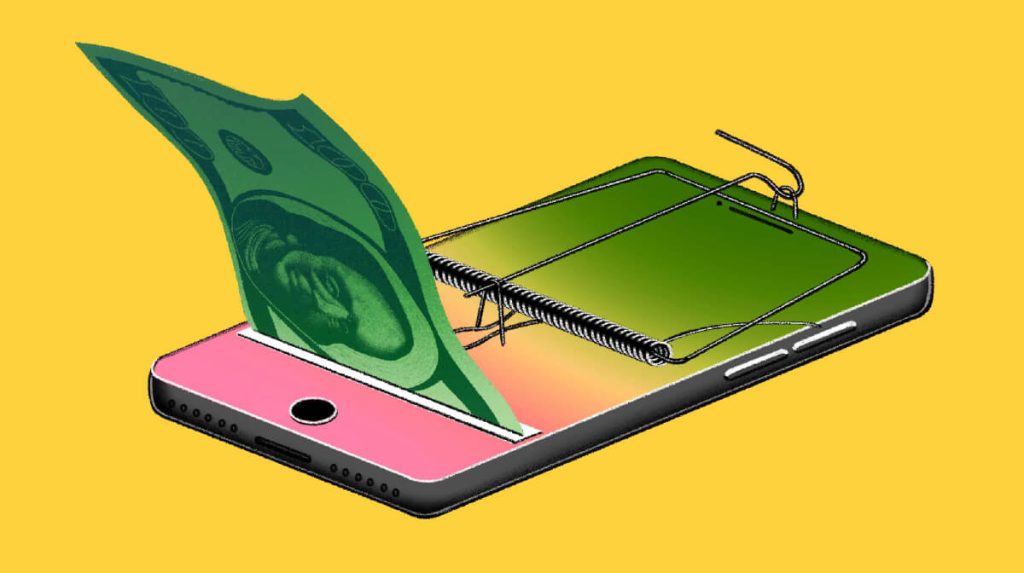

Do you feel cheated by a loan app in Nigeria? Have you been scammed or subjected to unfair loan practices? Do you want to report the loan app and seek justice? If your answer is yes, then this article is for you.

In Nigeria, loan apps have gained immense popularity, with many young people using them to access quick loans to fund their businesses, pay bills, or cover unexpected expenses. However, not all loan apps are trustworthy, and some engage in fraudulent activities, such as charging exorbitant interest rates, imposing hidden fees, or collecting personal data illegally.

Table of Contents

How to Report Loan Apps in Nigeria

If you have fallen prey to such loan apps, don't worry. Here's a step-by-step guide on how to report loan apps in Nigeria and protect yourself and others from being scammed.

Document the Loan Terms and Communication

The first step in reporting a loan app in Nigeria is to gather evidence of the loan terms and communication between you and the loan provider. This includes the loan agreement, repayment schedule, interest rate, fees, and any other terms and conditions.

You should also keep a record of all the messages, emails, or calls you had with the loan provider and any complaints or issues you raised. This evidence will be crucial in proving your case and seeking redress.

Contact the Loan App Customer Support

Once you have documented the loan terms and communication, you should contact the loan app customer support and raise your complaint. Most loan apps in Nigeria have a customer support team that you can reach through email, phone, or in-app chat.

Explain your issue clearly and attach the evidence you have gathered. Ask the customer support team to resolve your complaint and compensate you if necessary. Keep a record of your interaction with the customer support team, including their response time and the steps they took to address your complaint.

Report to the Central Bank of Nigeria (CBN)

If the loan app customer support fails to address your complaint or you are not satisfied with their response, you can escalate the issue to the Central Bank of Nigeria (CBN). The CBN is the regulatory body for financial institutions in Nigeria and has the power to investigate and sanction loan apps that violate the rules and regulations.

To report a loan app to the CBN, you can visit their website and fill out the complaint form. Provide all the necessary information, including your personal details, the loan app's name, and the details of your complaint. Attach the evidence you have gathered, and submit the form.

Report to the Police or EFCC

If you have been scammed or defrauded by a loan app in Nigeria, you can report the case to the Nigerian Police or the Economic and Financial Crimes Commission (EFCC). These law enforcement agencies are responsible for investigating and prosecuting financial crimes in Nigeria.

You should visit the nearest police station or EFCC office and file a complaint. Provide all the evidence you have gathered, including the loan agreement, communication, and any bank statements or receipts. The police or EFCC will investigate your complaint and take legal action if necessary.

Spread Awareness and Educate Others

Reporting a loan app in Nigeria is not only about seeking justice for yourself but also about preventing others from falling into similar traps. You can spread awareness about fraudulent loan apps and educate others on how to identify and avoid them.

You can share your experience on social media platforms, review sites, or consumer protection groups. You can also participate in advocacy campaigns and support initiatives that promote responsible lending and financial education in Nigeria.

In conclusion, reporting a loan app in Nigeria requires patience, persistence, and evidence. By following the steps outlined in this guide, you can protect yourself and others from being scammed and hold loan apps accountable for their actions.

FAQs

Can I report a loan app for charging high-interest rates?

Yes, you can report a loan app to the Central Bank of Nigeria if they charge interest rates that violate the regulations.

What evidence should I gather to report a loan app?

You should gather the loan agreement, repayment schedule, interest rate, fees, communication with the loan provider, complaints, and any other relevant documents.

Can I report a loan app to the police if I can't repay the loan?

No, you cannot report a loan app to the police for non-payment of a loan. You should negotiate with the loan provider or seek legal advice.

How long does it take to resolve a loan app complaint?

The duration for resolving a loan application complaint is contingent upon the severity and complexity of the problem. The resolution process may take a few days to several months.

How can I avoid fraudulent loan apps in Nigeria?

You can avoid fraudulent loan apps by checking their licenses or registration with the CBN, reading the terms and conditions carefully, and comparing their interest rates and fees with other loan providers.